With Tally.ERP 9, you can appropriate the expenses incurred during a sale, to the value of the goods for calculating VAT. You can also print the tax invoice with rate inclusive of tax for each item.

Similarly, you can record other tax payments to be made to the VAT authorities. After activating GCC VAT for your company, you can record different kinds of sales such as domestic sales, sales within GCC countries, sales to overseas tourists, and so on. Ensure that these ledgers are grouped under Direct Expenses, Indirect Expenses, or Current Liabilities.ĩ. Select the type of payment to be made to the GCC VAT authorities.ġ0. Enter relevant details in the Bank Allocations screen, and press Enter. To make payments for interest or penalty, select the ledgers that were created to account for these dues. The payable amount appears automatically.Ĩ. Select the other ledgers, as required. The Stat Payment Details screen appears as shown below:ħ. Select the VAT ledger.

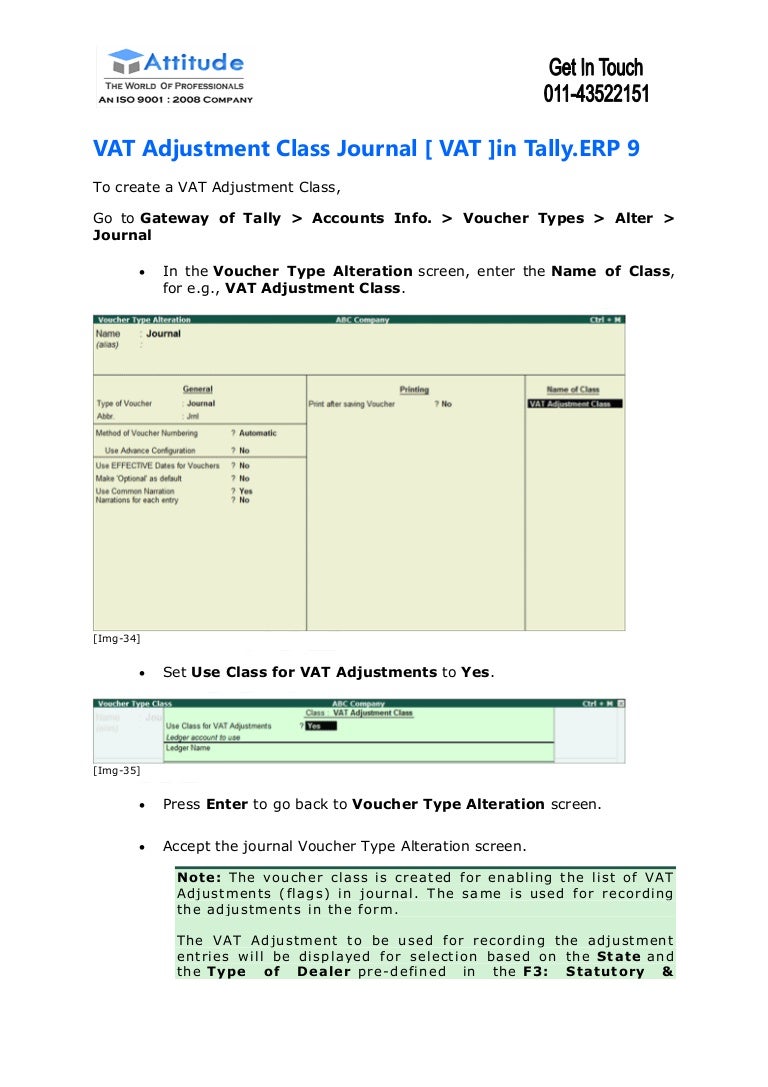

Journal entries in tally is NOT used for recording ALL KINDS transactions.Generally transactions recorded through journal voucher in tally erp9 does not include cash or Bank account. In the Stat Payment Details screen.ģ. Retain or change the Period From and To dates.Ĥ. Select the Payment Type. Journal Entry in Tally.ERP9 is a different concept than what we have learned theoretically from our class rooms. Other payments made to the authorities, such as interest and penalty, can also be recorded using this voucher – Tally UAEġ. Go to Gateway of Tally > Display > Statutory Reports > VAT > VAT 201 .Ģ. Click S: Stat Payment. TALLY ERP9 6.You can record a payment made to the GCC VAT authorities using a payment voucher. Bank to Bank transaction Introduction to Voucher Entries and Ledger Creation in Tally ERP 9 Tutorial - Lesson 3 Tally Accounting Tutorial in Nepali | Learn Tally erp in Nepali | नेपालीमा Tally सिखौ Tally ERP 9 Material In-Out Voucher Job Worker 37 Tally Full Course in kannada (year 2020 New version) Learn full Tally ERP 9 in kannada ಟ್ಯಾಲಿ Input and output vat single tax transactions in Tally.ERP9 (Part-1)/S.NO.-30 Learn Full Tally in 30 Minutes with GST - Learn Accounting in 30 minutes - 1 जाने Transport Accounting को कैसे Maintain करे वो भी Tally ERP 9 Software से । Garment Module in Tally (Part -1) :Size & Color creation, Price List Creation, Billing & Report How to configure VAT in Tally ERP9, VAT Set up Do voucher entry without using Dr. GST Accounting Entries CGST, SGST How to change VAT rate from 5 % to 15% in Tally ERP.9 | Saudi Arabia FIFO Closing Stock Valuation as per Income Tax Act, 1961 in Tally Tally.ERP 9 in Hindi ( VAT Entry, VAT Computation, VAT Payment Entry - 3 ) Part 75 Top 22 Short cut key in Tally erp 9 9. पुराना सर दर्द Ki Home Remedy Closing Stock Entry in Tally - Easy Explanation - Hindi 28.

0 kommentar(er)

0 kommentar(er)